In our previous blog post, we discuss the stark truth that over half of working Americans are lacking adequate disability insurance coverage while the chances that most of us will suffer from an acquired disability that keeps us from work before we reach retirement age are pretty high. We may think that our federal disability program (SSDI) will be sufficient in case of disability. In this post, we examine Social Security Disability Insurance more closely and look at how individual DI coverage can provide when SSDI may not.

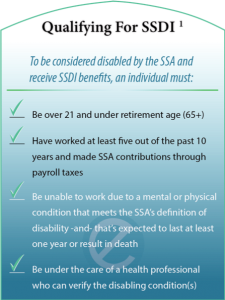

What is SSDI anyway? Social Security Disability Insurance is a federal program funded by payroll taxes that provides some income replacement benefit during long term (12+ months) or terminal, non-work-related disabilities for qualifying individuals. 1 (Figure 1 to the right) gives the SSA’s requirements for applying for SSDI benefits.

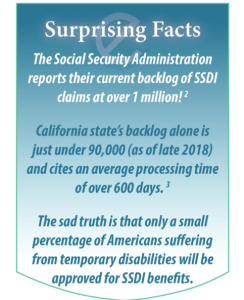

The SSDI approval process is notoriously long and arduous. Even if you meet the qualifications and apply, the SSA’s current backlog and processing times are staggering (see figure 2), and most applications face at least one denial and appeals hearing before final determination. During the wait, there may be other state and local resources available, but it will ultimately be up to the individual to keep themselves afloat financially until benefits SSDI benefits take effect.

What about situations where SSDI is not an option? There are plenty of circumstances where SSDI is not a viable option and alternate coverage will be needed, including:

- Your disability is not terminal and not expected to last over a year (short-term disability)

- You’re partially disabled for a time and may have limited capacity for some work but not able to perform your usual job.

- You are disabled, but the SSA does not recognize your condition as a qualifying disability or your application is denied for other reasons.4

Since SSDI will not provide benefits for short-term nor partial disabilities, what options are available? The states of California, Hawaii, New York, New Jersey and Rhode Island may have state-funded disability options available depending on

the circumstances. Other states offer income assistance and other income-dependent social/financial aid, but not a specific state SDI benefit program. 5 Some employers may also offer group short- or long-term disability coverage, and you may even have the option of electing more coverage through them.

In all cases, it’s up to the individual to determine if they will be covered in the event of a short- or long-term acquired disability. The good news is that there are individual SDI and LDI policies available that can be tailored to your individual needs. These policies can ensure that you’ll receive income protection when state and federal programs won’t be an option or while you’re waiting for an application to be accepted and benefits to kick in. Some benefits of individual coverage include:

- Providing benefits in the absence of group coverage or to supplement an employer-sponsored group policy

- Coverage for conditions that may not be included in your state’s or the SSA’s definition of a disabling condition

- Partial income protection in the case that you’re not fully disabled, but cannot work at full capacity

- May cover a higher percentage of your base salary than an employer’s group policy or state and federal programs provide

- Providing income protection during the (lengthy) SSDI approval process

At eIndividual, we are passionate about providing the resources and options that give you peace of mind and protect your life and assets, especially during times of disability. Call us today and let us help you learn more and determine which STI and LTI policies make sense for your life.

Sources and other links to check out:

1 https://www.truehelp.com/understanding-ssdi/about-ssdi/

4 https://www.nolo.com/legal-encyclopedia/social-security-disability-reasons-denial-32396.html

5 https://www.disabilitybenefitscenter.org/state-social-security-disability

And https://www.disabilitybenefitscenter.org/faq/temporary-disability-benefits

https://www.disabilitysecrets.com/going-broke-while-waiting-on-disability.html

https://www.bls.gov/opub/ted/2018/employee-access-to-disability-insurance-plans.htm

Crystal Clark is a full-time animal lover and change maker.

Recent Comments